Weekly Series: mREIT And BDC Recommendations (And Price Targets) As Of 09/07/2025

Summary

- We’re back to the weekly updates following the Labor Day weekend.

- No purchases in the last week, though we had a few leading up to Labor Day.

- NYMT is becoming ADAM. All sheets we provide to subscribers will be updated soon. For this edition of the article, we will still refer to them as NYMT.

- Quiet week for BDCs when it comes to NAV. The week was positive for mREIT book values and the agency mREITs had slightly larger gains.

- RITM receives a 5% recommendation range and risk/performance upgrade after the Crestline Management acquisition, boosting price target by $0.65 per share. - Added to main points after sending the email.

In the exclusive section for full members:

- All of the current ratings and price targets, as we do each time we publish this article.

- The REIT Forum’s Q2 2025 estimates by Scott Kennedy for earnings and book values or net asset values.

- Tables comparing results to projections.

- The dividend projections for each mREIT and BDC for Q3 2025.

We aim to retain the same layout from week to week. I hope that makes it easier to find the parts that are most relevant to you.

Weekly Notes From Colorado Wealth Management Fund

Positions: 0 trades over the last week. In the week prior to Labor Day, I started a position in TWO-A and increased my positions in SBA Communications (SBAC) and Equity Lifestyle (ELS).

- Trade alert from 08/27/2025 (This one is TWO-A and SBAC)

- Trade alert from 08/28/2025 (This one is ELS)

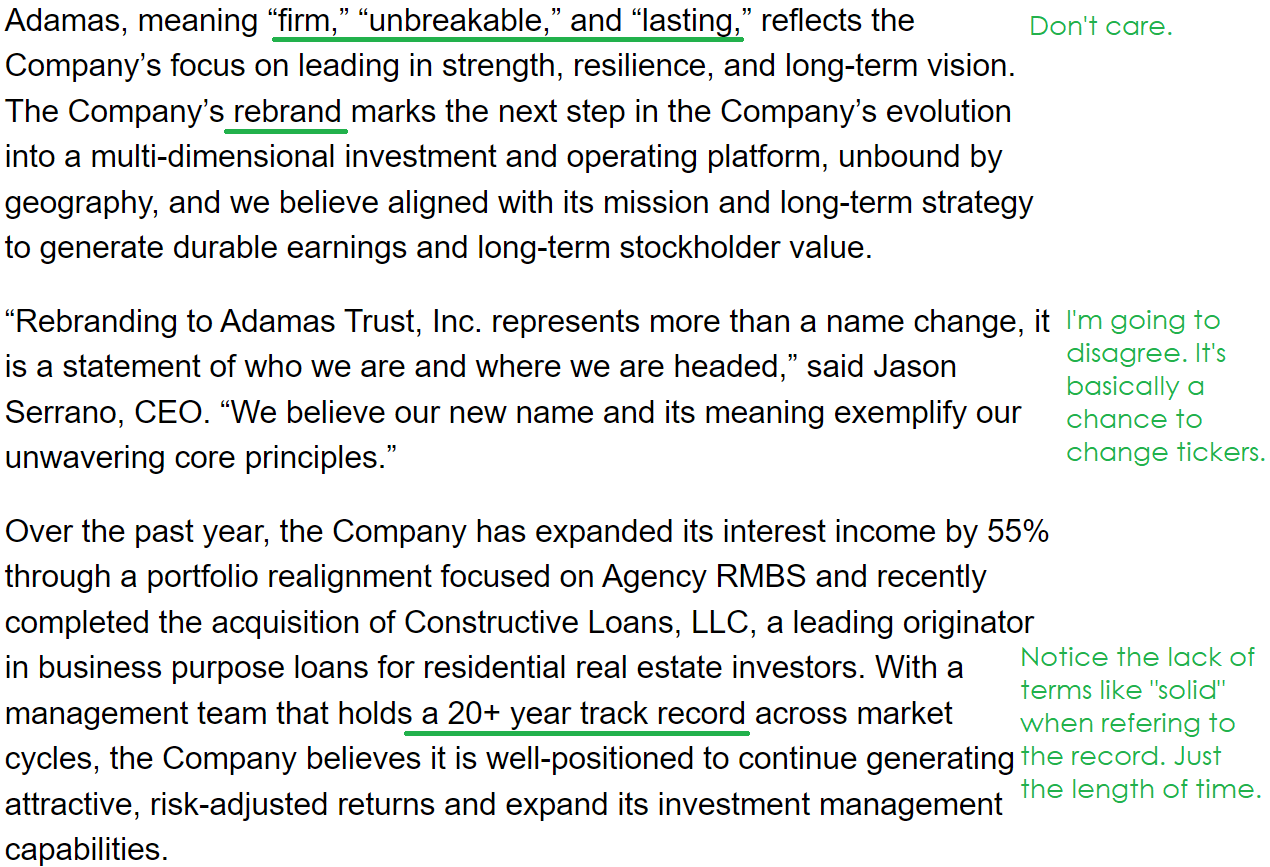

Commentary: New York Mortgage Trust (NYMT) is now Adamas Trust, Inc. (ADAM). Do I find this decision to change the name useful? No, I do not. I grabbed the description from the company press release and added my own thoughts to it:

Source: Screenshot from Seeking Alpha, notes by author

So in brief, we’ll be updating a bunch of tickers (common share, preferred shares, and baby bonds). In this article, we are still referring to the company as NYMT. Sheets will be updated soon.

Scott’s Ultra-Brief Summary

“Another fairly quiet week for BDC NAVs. A positive week for mREIT BVs as a whole. Larger projected gains for the agency mREITs as a whole versus the other 3 sub-sectors. I upgraded RITM's percentage recommendation ranges by 5% this weekend. This resulted in a $0.65 per common share increase. This was directly due to the Crestline Management acquisition. I discussed this acquisition and upgrade briefly in point "3b" within my longer section below.”

Weekly Notes From Scott Kennedy

Positions: 0 trades over the past week. 1 trade in late August prior to the Labor Day holiday weekend (purchased BXSL as a “starter” position [small in size]).

- Scott's Trade Alert from 8/26/2025 (purchasing BXSL)

In general, I am being patient regarding selectively deploying capital in attractively-valued mREIT common stocks with a less attractive risk/performance rating. My sector allocation to mREIT common stocks remains high (thus aligning with continuing to hold existing positions and selectively adding for future appreciation over the long-term). Patience remains key as catalysts/events will take time to play out (especially within commercial/multifamily mREITs). I will continue to remain disciplined regarding “picking and choosing” investments and lot sizes.

BDC Weekly Change: This past week, high yield/speculative-grade credit spreads were, once again, relatively unchanged. As of early September 2025, we have continued to see a decent retracement in high yield/speculative-grade credit spreads after a very volatile April 2025. This is mainly due to continued optimism regarding tariff negotiations and semi-attractive economic data (inflation remaining fairly subdued, relatively flat unemployment rate, etc…). Spreads remain relatively unchanged during calendar Q3 2025 (through 9/5/2025).

BDC Other Comments (Current Week):

I will continue to monitor Middle East and Russia/Ukraine geopolitical tensions and monitor impacts in high yield/speculative grade markets as new events unfold. I continue to not anticipate any material/notable direct impacts to the BDC sector from these events. I am also monitoring all ongoing tariff updates and their impacts to each BDC’s underlying portfolio companies via weekly credit research. As is always the case, I will continue to monitor upcoming U.S. economic data/monetary policy and each event’s impact to the BDC sector.

Calendar Q1 2025 + Q2 2025 + Q3 2025 Recommendation/Target Range + Risk/Performance Upgrades (Downgrades) (Running Tally):