Targets Added: CIMP, AGNCZ, RITM-E plus Updates for Baby Bonds and Preferred Shares

Targets added for:

- CIMP (baby bond)

- AGNCZ (fixed-rate preferred share from AGNC)

- RITM-E (fixed-rate preferred share from RITM)

We also completed updates for price targets for:

- Baby bonds

- Preferred shares

All of the ratings (and our positions) can be seen in the REIT Forum Google Sheets.

I don’t like to put the targets directly in the article, because then investors may miss an ex-dividend date that the sheet would’ve caught for them. Targets update daily for dividend accrual.

Baby Bond Knowledge

This can be counterintuitive to many investors.

- A lower coupon reduces call risk.

- Rather than focusing on the coupon, investors should be looking at the other yield metrics.

Let’s compare two bonds that are both callable and mature in exactly two years. Both have a 9% yield to maturity.

- Bond 1: Coupon rate = 8.50%.

- Bond 2: Coupon rate = 4.00%. The majority of the yield to maturity comes from appreciation.

Since we know both bonds have a 9% yield to maturity, we know both trade at a discount to call value. In the current environment, neither bond is likely to be called. However, if interest rates fall, then there’s a chance the 8.5% bond would be called. But there’s very little chance the company would call the bond with a 4.00% coupon rate. Therefore, bond 2 is ever so slightly more attractive to investors who don’t need the cash flow immediately. Therefore, we would find bond 2 slightly more attractive. It would only win by a hair, but it’s a useful tool to have in mind when pricing bonds.

What that looks like in practice:

- Bond 1 might have a target requiring an 8.9% yield to maturity.

- Bond 2 might have a target requiring an 8.8% yield to maturity.

- The price target for Bond 2 would be materially lower to compensate for the lower coupon. But we might accept a slightly lower yield to maturity for the benefit of reduced call risk.

- In practice, this can be relevant with shares like GAINL. The “Buy Under” target is largely capped by call risk. The shares have an 8% coupon rate, low risk rating, and very reasonable maturity. All great, but the call risk limits the price target.

CIMP

This is a baby bond from Chimera Investment Corporation (CIM).

- Similar to CIMN and CIMO.

- Has a lower coupon rate at 8.875% vs CIMN at 9.00% and CIMO at 9.25%.

- Longer duration than CIMN and CIMO.

- The impact of longer duration exceeds the value of potentially lower call risk, so we are requiring higher yield to maturity for CIMP.

AGNCZ

This is a fixed-rate preferred share from AGNC Investment (AGNC).

- Most similar to NLY-J and RITM-E. All other AGNC preferred shares are floating or fixed-to-reset.

- AGNCZ currently offers a lower yield than any of the floating-rate shares, but it could be competitive with a few more cuts to the fed funds rate.

- AGNCZ’s yield is better than AGNCL (fixed-to-reset) before AGNCL resets. However, AGNCZ’s yield is also better than the yield on AGNCL would be if it reset today.

RITM-E

This is a fixed-rate preferred share from Rithm Capital Corp. (RITM).

- Comparable to NLY-J and AGNCZ, but RITM-E carries a higher risk rating.

- Like AGNCZ, RITM-E has the potential for yielding more than the lowest floating-rate shares from the same company. RITM-C is offering 9.49% while RITM-E currently yields 8.81%.

- We have a position in RITM-E to speculate on a potential rally. The market’s reception of NLY-J and AGNCZ was quite favorable, which makes RITM-E more interesting.

Baby Bond Target Updates

The following chart demonstrates the changes:

Shares are not in alphabetical order. That’s right. They are listed in the same order as in the google sheets:

- Sorted by risk rating (ties are arbitrary but keep the shares from the same REIT together).

- Sorted again by maturity dates.

Note: I added targets for CIMP based on the prior interest rates so it could go through the update process along with the other baby bonds. This simply gives investors a better feel for the impact of the swing in interest rates and didn’t increase the time materially.

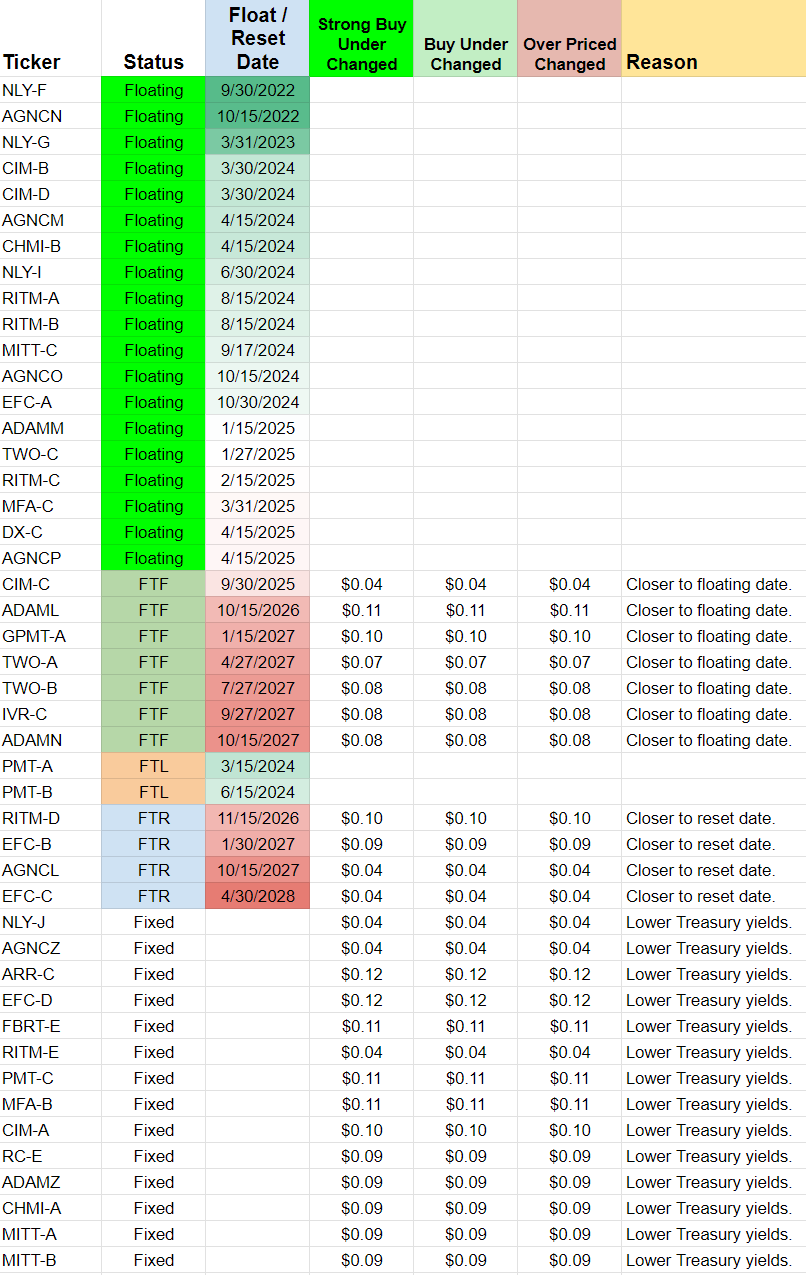

Preferred Share Target Updates

We have two ways to present this chart.

The first chart is prepared in the same order as the Google Sheets:

The second chart is prepared the way I see the updates while I am preparing them.

This presentation sorts shares by:

- Type of share (floating, fixed-to-floating, etc.)

- The date the shares float or reset

In this view, it’s pretty obvious to see the connection.

Note: CIM-C technically begins floating today. I left it as FTF (fixed-to-floating) for this image, but it will be marked as floating-rate in the sheet.

Conclusion

A modest dip in Treasury rates leads the baby bonds and fixed-rate preferred shares to become a bit more attractive. Targets are adjusted moderately higher to reflect the change in rates.

Member discussion