Rexford Q3 2025 Earnings Update

Summary

- Beat consensus estimates and raised guidance on Core FFO per share and implied AFFO per share.

- Guidance for cash same store NOI foreshadows better AFFO per share.

- Leasing spreads remained solid while leasing volume soared. Guidance for occupancy increased slightly.

- REXR repurchased about 1.65% of the weighted-average shares outstanding at $38.62.

- Solid quarter. Performance continues to support our targets and our large position.

Rexford Core FFO and AFFO Per Share

Rexford (REXR) results:

- Core FFO per share of $.60. Beats consensus estimate of $.59 by $.01.

- AFFO per share of $.51. Beats consensus estimate of $.49 by $.02.

Note: REXR does NOT report “AFFO” in the press release. However, they do include total AFFO in the supplemental. Consequently, we can calculate AFFO per share.

Guidance

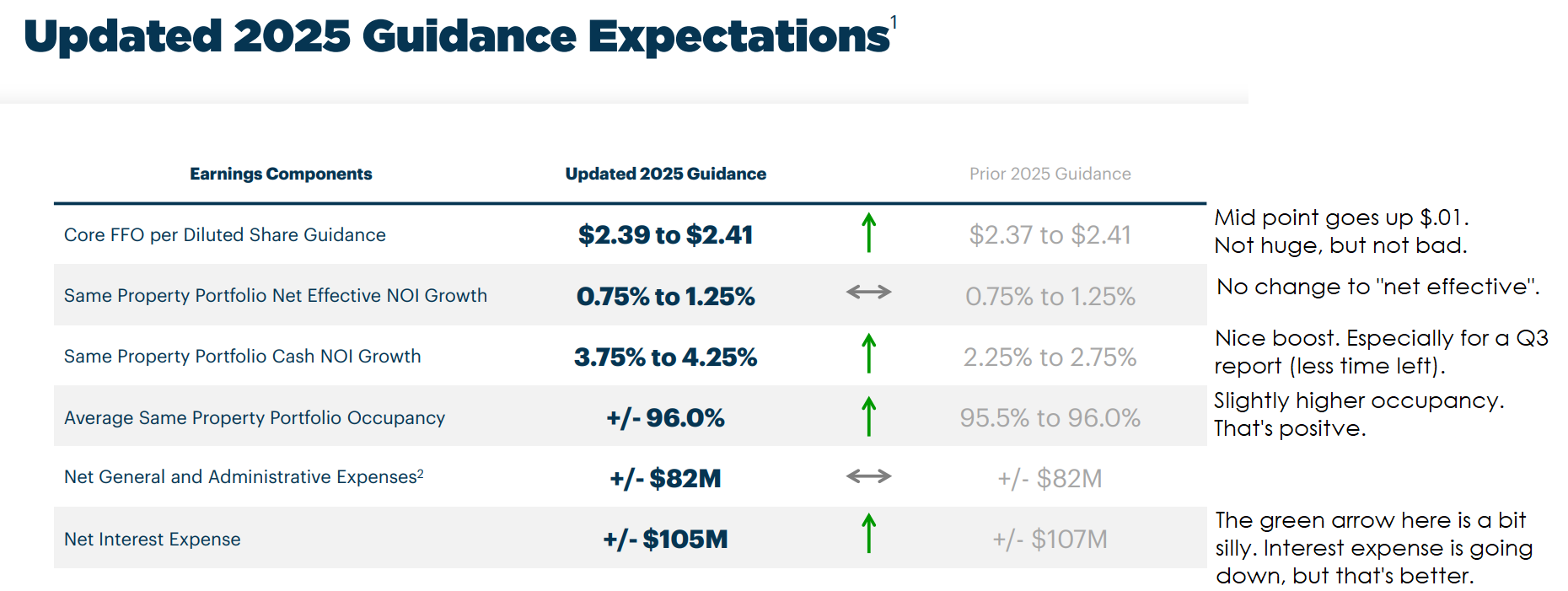

REXR had a healthy boost to guidance:

This merits a little math.

Core FFO per share guidance is up $.01. That’s pretty much all driven by net interest expense.