Quick Notes About EFC Preferred Shares

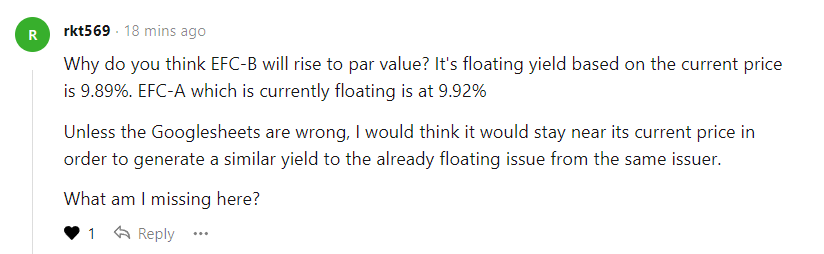

I got a great question from rkt569 on the June Portfolio Update:

That question is outstanding and it deserved an immediate answer. However, I think the topic is also worthy of an article. Why? Well, the question made me think and revisit the sheets to check all my calculations. So long as readers enjoy me writing about math (we can just pretend for now), this is a great topic for an article.

I'll walk readers through our process.

Just one note first. If you're new to our website, please enter your email address below. Thank you! If you don't see a box to do it, then you're already set.

My Reply, But Expanded and Formatted

Great question. I've had the implicit assumption that we wouldn't see short-term rates remain above the 5-year Treasury rate indefinitely. However, it is certainly a possibility.

EFC-A Comparison

EFC-A is a floating-rate preferred share. It uses 3-month LIBOR, which is defined as 3-month SOFR + 0.26161%. Presently that means EFC-A's dividend rate is calculated as:

- Floating spread + SOFR adjustment to reach LIBOR + 3-month SOFR = Annualized Dividend Rate.

- 5.196% + 0.26161% + 4.33% = 9.785%

- 9.785% * $25 = $2.44625 annualized dividend rate.

Note: If we want to get extremely technical, EFC-A uses a 360-day year but calculates dividends using the actual number of days between ex-dividend dates. Therefore the actual dividend payments on average will be about (365-360)/360 = 1.3889% higher than calculated here.

- EFC-A trades at $25.20, but has about $.55 of dividend accrual. Therefore, we calculate a stripped price of $25.20 - $.55 = $24.65.

- The dividend rate of $2.44625 / $24.65 = 9.92%. Therefore, we calculate a stripped yield of 9.92%.

If the 5-year Treasury rate is below the 3-month LIBOR rate (which is 3-month SOFR + 0.26161%) then that creates a challenge for the valuation of EFC-B.

EFC-B's dividend rate, if it were to reset last night, would be:

- Reset spread + 5-year Treasury Rate

- 4.99% + 3.99% = 8.98%

- 8.98% * $25 = $2.245 annualized dividend rate.

If we assume that investors demand a 9.92% dividend rate on any preferred share from EFC, then EFC-B would be unlikely to appreciate much.

However, I think EFC-A's valuation ($25.20) is also at least somewhat impacted by the call risk. The worst cash to call is $.34, so upside is limited. But perhaps not limited so tightly as to infer that the market would raise the bid for EFC-B ($23.06) significantly due to the combination of yield and upside.

EFC-C Comparison

On the other hand, we have EFC-C ($25.24) is also a 5-year Treasury rate reset share. It started with a higher coupon rate for the fixed-rate period (8.625% for EFC-C vs. 6.25% for EFC-B) and only a tiny bit larger floating spread (5.13% vs 4.99%). That difference in floating spreads is only $.03 per share per year, so not a big deal.

EFC-C has an 8.81% stripped yield. If shares were resetting today to 5.13% + 3.99% = 9.12%, then the stripped yield would be 9.21%. That is because the stripped price is $24.75.

Math: $25.24 market price - $.49 dividend accrual = $24.75 stripped price.

What would it take for EFC-B to match a 9.21% stripped yield?

EFC-B would have an 8.98% coupon rate, so it would need a stripped price of $24.39. Including the dividend accrual of $.35, that would be a market price of $24.74.

Note: If these shares had actually reset, the dividend accrual would be higher because it would be based on the higher coupon rate. However, that seems a bit excessive for adjustments in a hypothetical.

I believe EFC-C was overpriced at $25.24. I don't think that's a normal transaction. There were just a few shares (okay, a few hundred) where someone severely overpaid. So we could probably drop about $.30 to $.40 from both prices to make a more realistic comparison.

Note: Upon seeing the price so high I went to see if there was a big bid for EFC-C at $25.24. If there was, I would've issued an immediate brief article suggesting members (paid subscribers) who own shares may want to dump them and lock in the gain. However, the actual bid is $24.85 and the ask is $25.05. It was just a case where the most recent transaction was overpriced.

EFC-D Comparison

We could also look at EFC-D ($22.99). This is a fixed-rate share with a 7.00% coupon rate. The stripped yield is 7.61%.

Note: EFC-D has a different schedule for ex-dividend dates than the other preferred shares from EFC. Consequently, EFC-D is ex-dividend today but we have 6/30/2025 as the ex-dividend date for the other preferred shares from EFC. It's not hard to keep track of when we include the ex-dividend dates in the Google Sheets for REIT Forum subscribers.

EFC-D benefits from upside potential due to the larger discount to call value. However, it is only $2.01 under call value. EFC-B is $1.94 under call value before dividend accrual. After dividend accrual, EFC-B's $23.06 market price is only a $22.67 stripped price. Therefore, EFC-B actually has an even larger effective discount to call value at $2.33.

Therefore, EFC-B would have a significantly higher yield when it resets and it currently has a larger effective discount to call value. Therefore, if we use EFC-D in the valuation process, it would imply that EFC-B needs to trade higher.

I believe EFC-D is being valued quite richly at $22.99. The potential upside isn't high enough to warrant a stripped yield of only 7.61%.

If EFC-B were to trade at a 7.61% yield after shares reset, it would be well above $25.00. I do not believe this would be a realistic scenario.

Conclusion

- Relative to EFC-A, current pricing seems about right. Upside would be limited.

- Compared to EFC-C or EFC-D, shares of EFC-B look much more appealing.

All things considered, we may want to use all 3 other preferred shares as comparisons. In that case, I think the price targets are about right for current trades. However, the expectation that EFC-B would climb to about $25.00 by the time the dividend resets on January 30th, 2027 (assuming no recession) is probably a tad too optimistic.

If it were to trade up to $25.00 by the call date, it would result in an annualized return of about 12.8% over that time due to the combination of dividends and appreciation.

As it stands, EFC-B trades very slightly above our "buy under" target. Including the dividend accrual, our current "buy under" target for EFC-B is $23.01 (vs. $23.06 market price). As shares approach the ex-dividend date, that price trends higher. The day shares go ex-dividend, that target drops by the amount of the dividend.

Disclosure: Long EFC-B.

Note: It is possible that there might be a typo somewhere. This is the kind of article where it is easiest to create them. If there is one, someone will probably call it out in the comments shortly. Calling out any error is greatly appreciated! I have thick skin and it's better to have any typo corrected than to give a reader incorrect information.

Member discussion