REXR: Q3 2023 Guidance Up, Market Rent Down

Rexford (REXR) announced earnings for Q3 2023.

Relevant documents:

There are a few things I want to highlight.

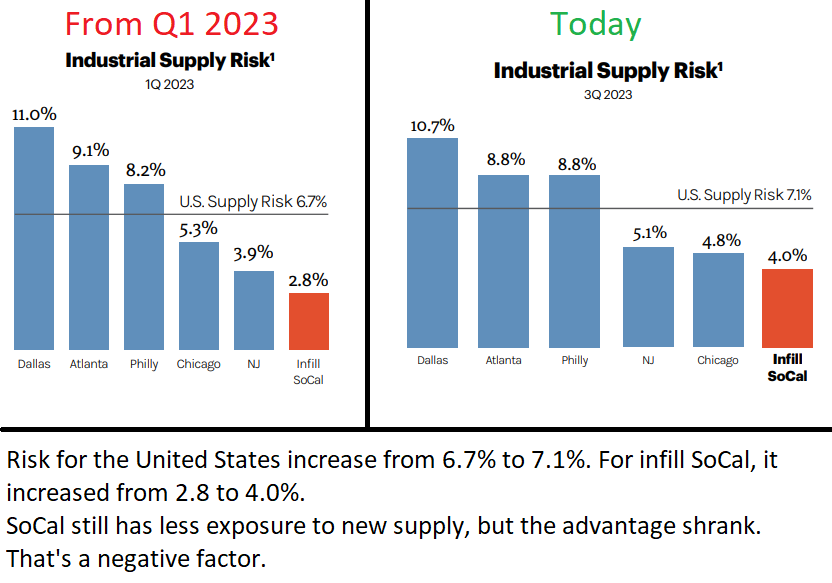

Industrial Supply Risk

See chart:

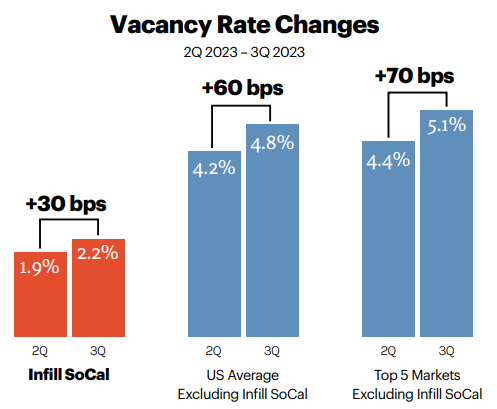

Infill Southern California Vacancy Rates

As of Q2 2023: 1.9%

As of Q3 2023: 2.2%

The increased vacancy rate in the market may be a factor pressuring leasing spreads. However, it feels a bit strange because vacancy rates increased more in other markets:

The unique aspect is that Southern California regularly has the lowest vacancy rate. After the recent history, tenants may feel that 2.2% is far more comfortable.

What is driving vacancy up? It would be tempting to blame it on the disruptions created by the union. That answer simply makes sense. But it wouldn’t explain the increase in other markets. Supply is a bigger issue, as well as some tenants being a bit apprehensive about the macro environment.

Fortunately, the union negotiations have been resolved (for now). This is an issue with the dockworkers, not REXR employees. Details have been hard to find regarding some of the more important long-term points, like the use of automation to improve dock efficiency. Despite the high volume going through these ports, metrics on efficiency for North American docks are extremely unfavorable.

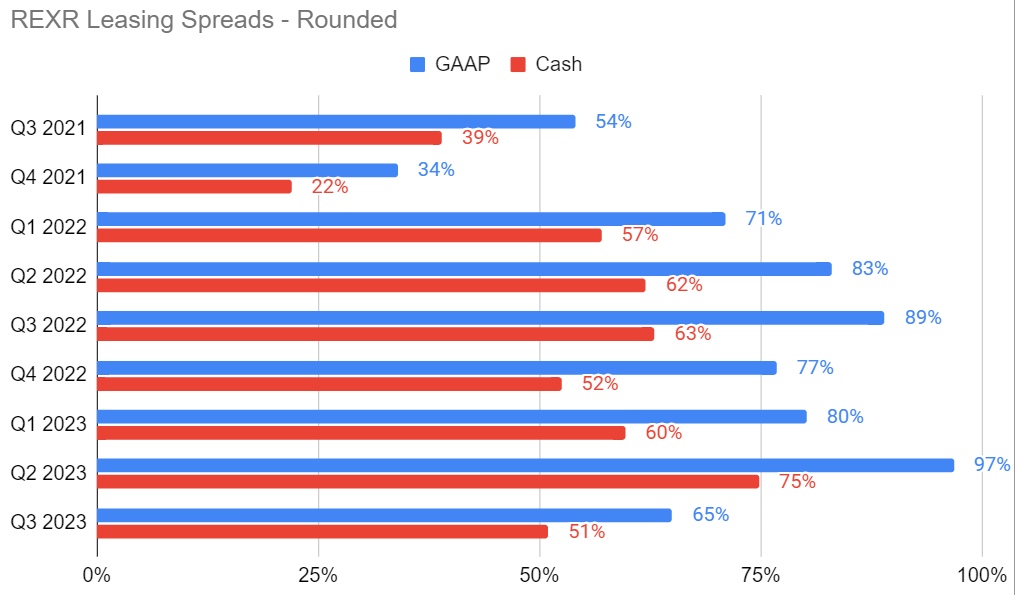

Leasing Spreads

They were still excellent but clearly down from prior quarters:

This is not a big surprise. It was telegraphed in prior presentations. This was primarily driven by which leases are expiring. Leasing spreads should be:

In the same general range for Q4 2023. It could be up or down. Q3 2023 had fewer cheap leases, so they were expecting leasing spreads to be lower. This was actually a pretty good performance.

Higher on average in 2024 when more of the really cheap leases expire.

Theoretically lower in 2025 (fewer cheap leases expire)

Higher in 2026 (more cheap leases expire)

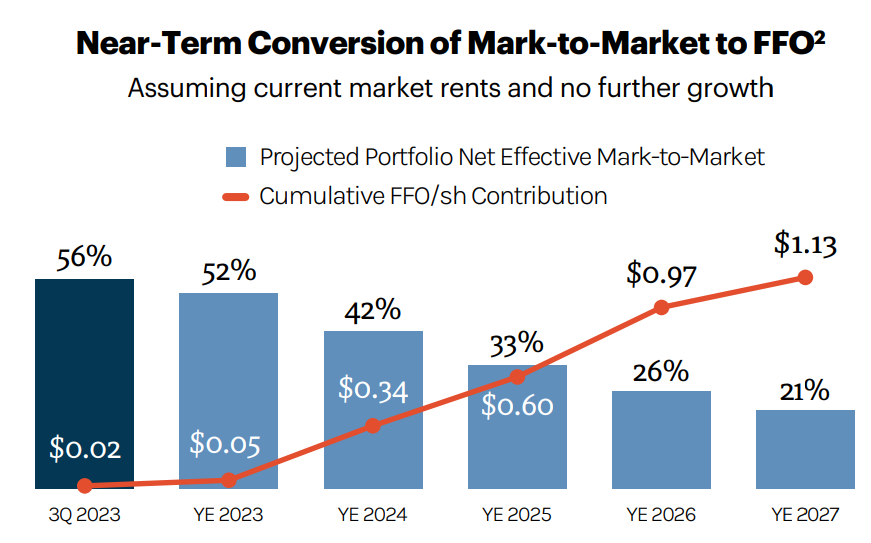

Market Rents Dipping

The remaining cash mark to market fell from 50% to 43%.

The “portfolio net effective” (closer to GAAP) mark to market fell from 63% to 56%.

Part of that decline is simply because of new leases at market rates replacing old leases. However, it also reflects market rents dropping. Using data provided by REXR, I’m estimating a roughly 400 basis point decline (4 percent) in market rents across the portfolio. This is worse than the decline in market rent projected using comments from Prologis (PLD).

Assuming market rents were frozen at levels from 9/30/2023, renewals would gradually convert the mark to market into new revenue. In that scenario, we would expect the portfolio net effective mark to market to follow this path:

This assumes zero growth in industrial rents. While market rents may go up and down each quarter, we are confident that they will trend higher over time.

Therefore, by 2027, the benefit to FFO should be greater than $1.13. For perspective, the current guidance for Core FFO is $2.16 to $2.18. Therefore, by 2027, the value should be 50% higher. That increase is just from rolling leases to current market rents.

These calculations consider the impact of interest rates, but REXR’s debt level is very low. Low debt is a great way to reduce exposure to interest expenses.

I would attribute much of REXR’s weaker performance over the last few months to the trend in rent levels and vacancy for the market, as well as the surge in Treasury yields driving investors to buy Treasuries over REITs.

Consensus Estimates

We have the following consensus estimates: