Crown Castle International Q3 2025

Summary

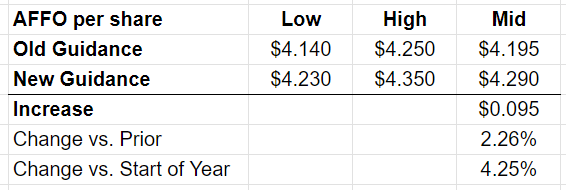

- Crown Castle International (CCI) raised full-year Core FFO guidance by 2.26%, reflecting better margins and lower interest expenses.

- 2025 AFFO is lower due to fiber asset sale accounting, but that's a big tailwind for 2026 and possibly 2027, depending on when the sale closes.

- I took the data CCI provides and improved the presentation. Now it's more useful.

- Tower REITs, including CCI, trade at attractive multiples. CCI's results support our long-term expectations for the sector.

Disclosure: Long all 3 tower REITs.

Crown Castle International Results

Crown Castle International (CCI) raised guidance again. The market is only mildly impressed. CCI is up on the day (but less than 1%) while peers are down and the equity REIT index ETFs are slightly down.

Guidance for Core FFO was bumped by 2.26%, which is a big bump for a third-quarter release: