Charts 2025-06-17

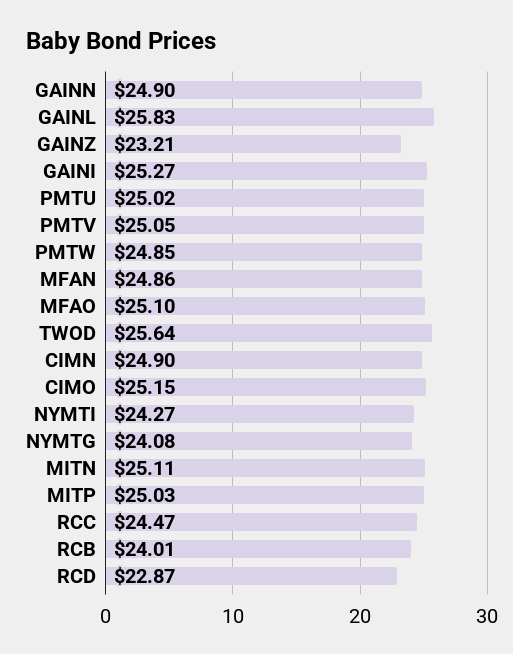

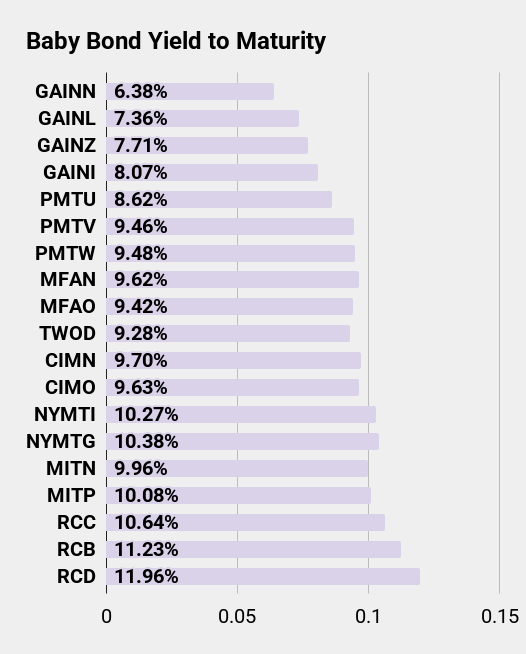

We have several charts here for our readers. We will happily consider adding more charts to our layout based on reader requests.

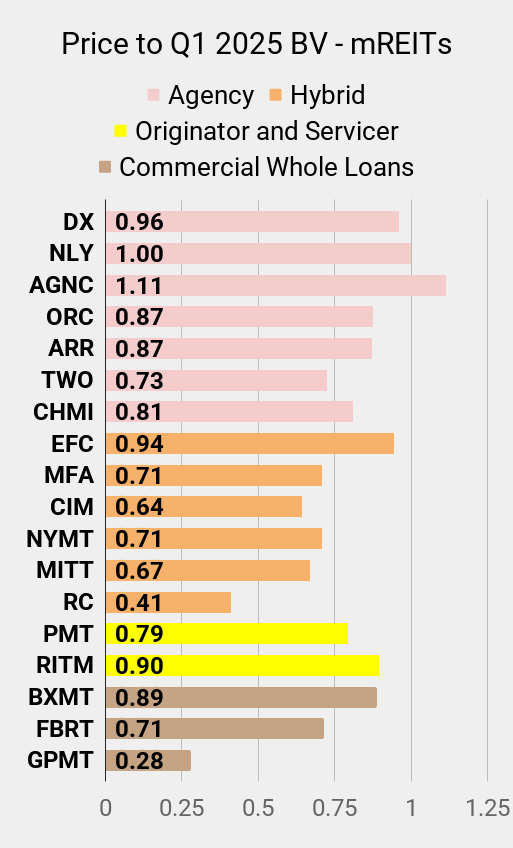

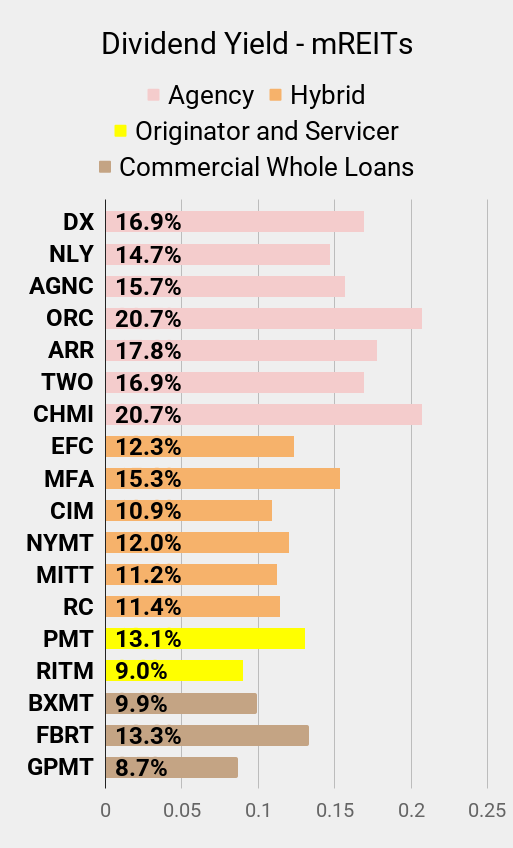

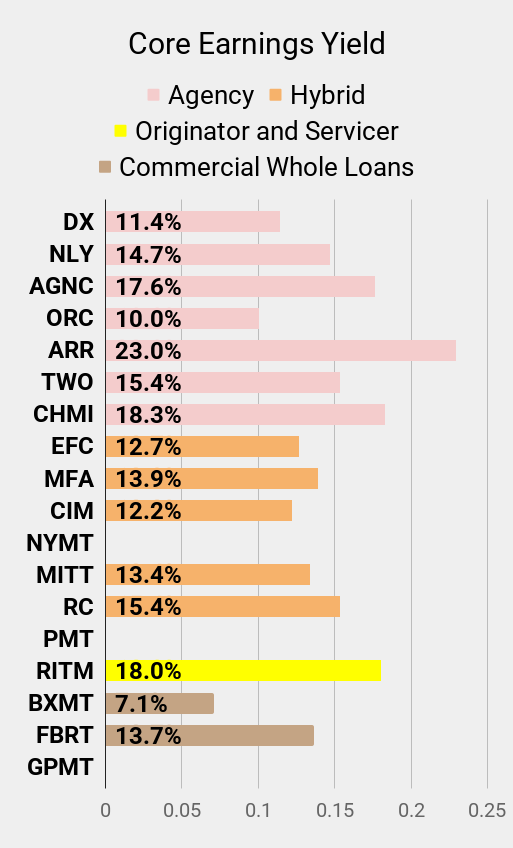

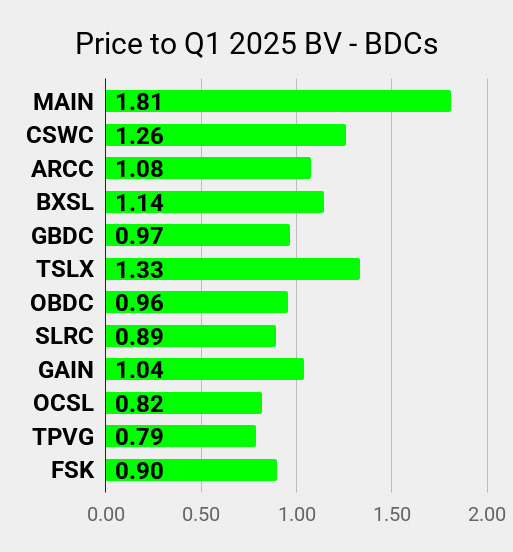

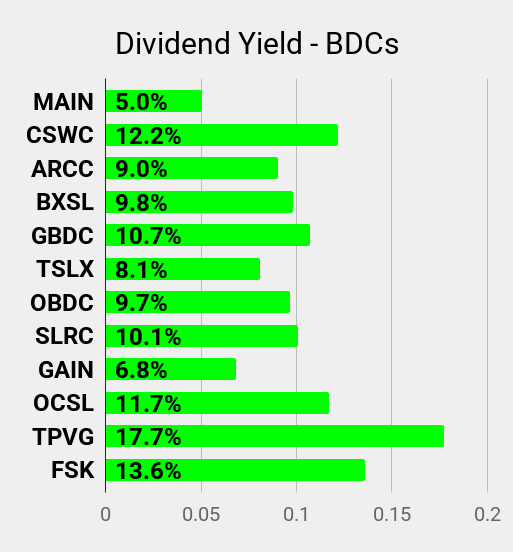

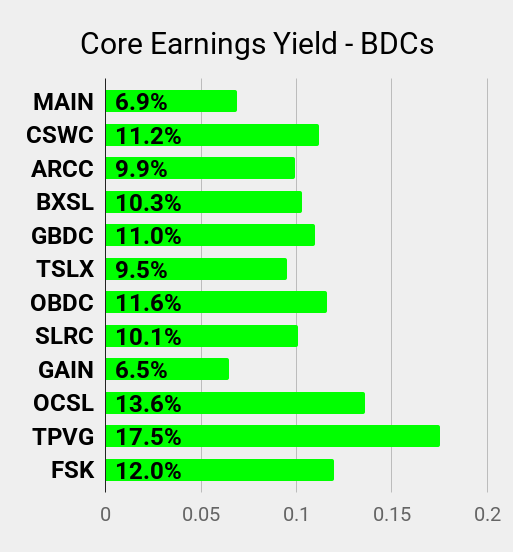

The charts for common shares (first 6 charts) are broken down as follows:

- All common shares of a given type (such as residential mortgage REITs) are grouped together.

- Within the group, shares are roughly sorted by risk rating. However, it is common to have several shares tied. In that case, the sorting becomes arbitrary.

- When risk ratings update in our internal system, the order in the charts may not be updated immediately because it is a unique system.

- PMT and RITM are the only two originator / servicer mortgage REITs. They are tied on risk rating, so sorting is arbitrary.

- PMT and NYMT do not provide a “Core EPS” metric, so their line is blank in the “Core Earnings Yield” chart.

- Finally, investors are cautioned that due to the way historical amortized costs and hedging are factored into core earnings metrics, it is possible for two mortgage REITs with substantially the same portfolio to report materially different “earnings” for a long time. For instance, ARR and ORC will show a dramatically different earnings yield due to those accounting factors, even though the portfolios are similar. Likewise, AGNC reports dramatically higher earnings than DX despite significant similarities in the portfolios.

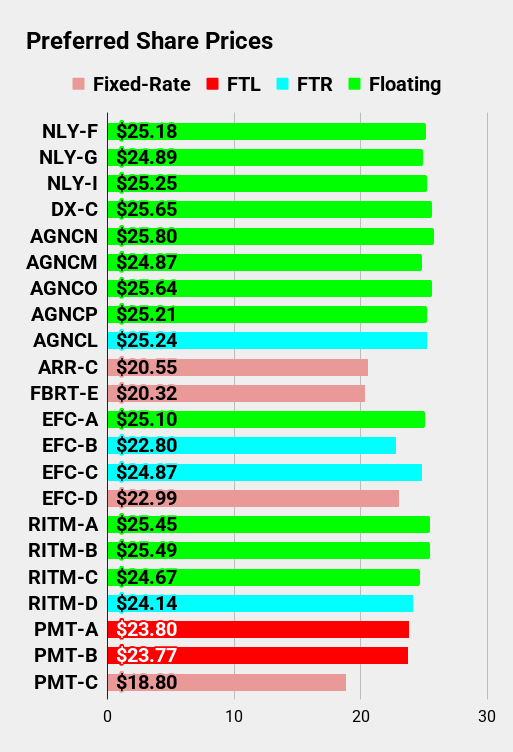

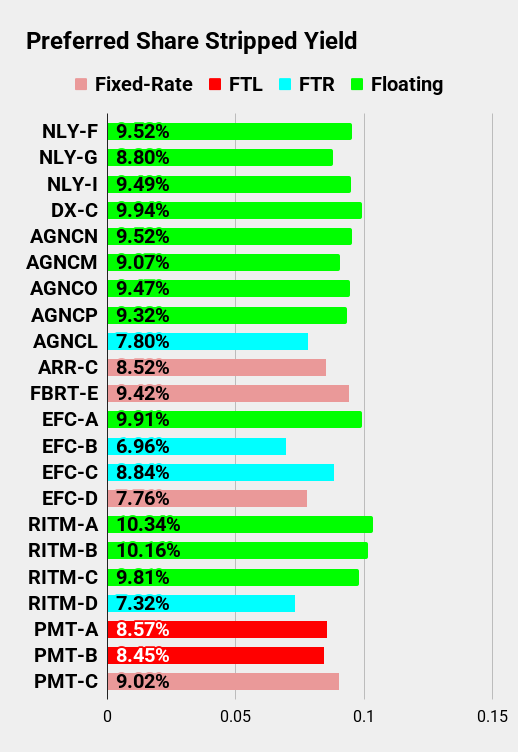

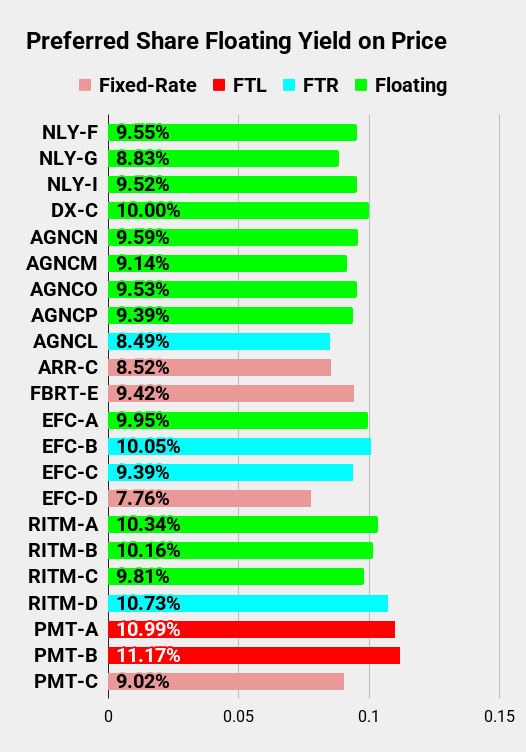

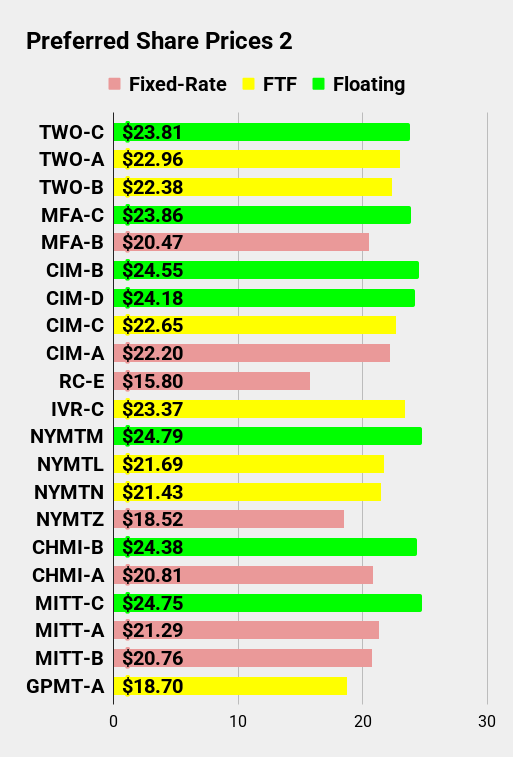

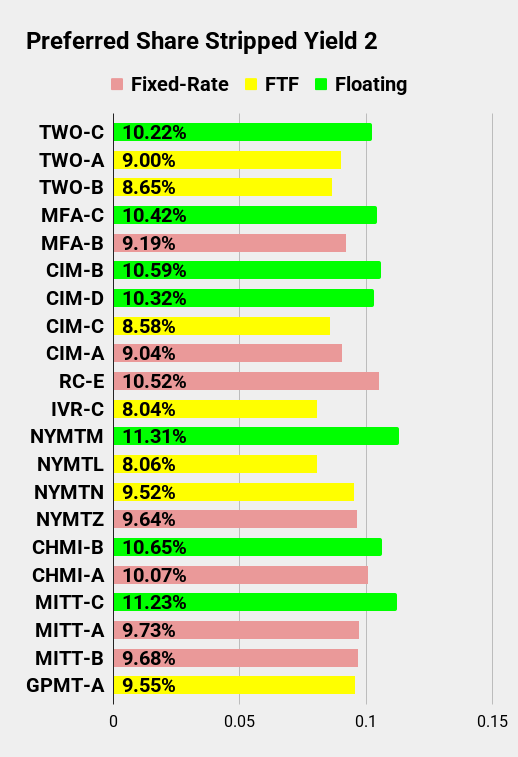

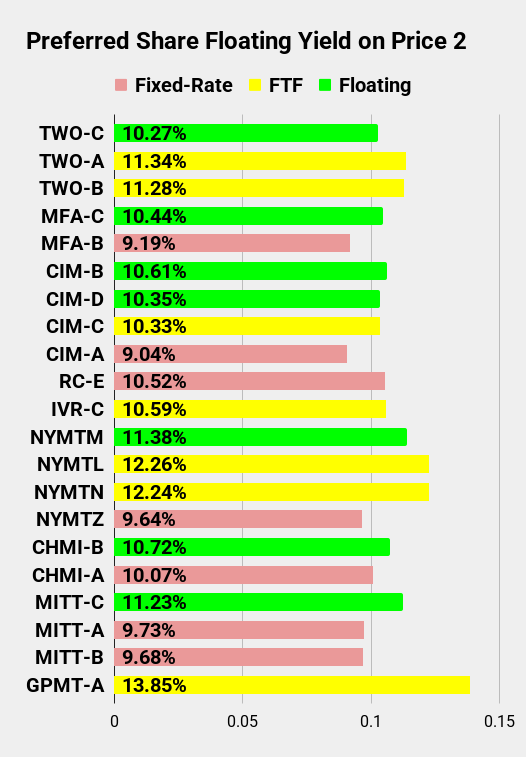

Some terminology:

- Fixed-Rate = The dividend is set at a specific rate in the prospectus and should not change.

- FTF = Fixed-to-floating. Share is currently fixed but will begin floating based on SOFR. We may reference LIBOR, but that's assumed to be SOFR + 0.26161%.

- FTR = Fixed-to-reset. Share is currently fixed. It will eventually begin resetting every 5 years based on the 5-year Treasury rate.

- FTL = Fixed-to-lawsuit. The company decided that their FTF shares could be "fixed-to-fixed" despite clearly violating the original intent of the contract.

- Floating = A share that was FTF, but is now floating. The dividend rate is updated every 3 months.

Your support is greatly appreciated. As readers tend to want a large volume of charts, uploading all of them became challenging. This method allows me to upload them in bulk, which means we can provide more images for you and provide updates more frequently.

Disclosure: Long RITM-D, EFC-B, PMTW, RITM, SLRC, GPMT, RC, GBDC, CIM

Member discussion