Annaly Capital Management Releases New Preferred Share With 8.9% Dividend Yield

Annaly Capital Management (NLY) is releasing a preferred share.

They've bucked the recent trends. Instead of using a fixed-to-floating or fixed-to-reset share, they've gone with the old style of fixed-rate.

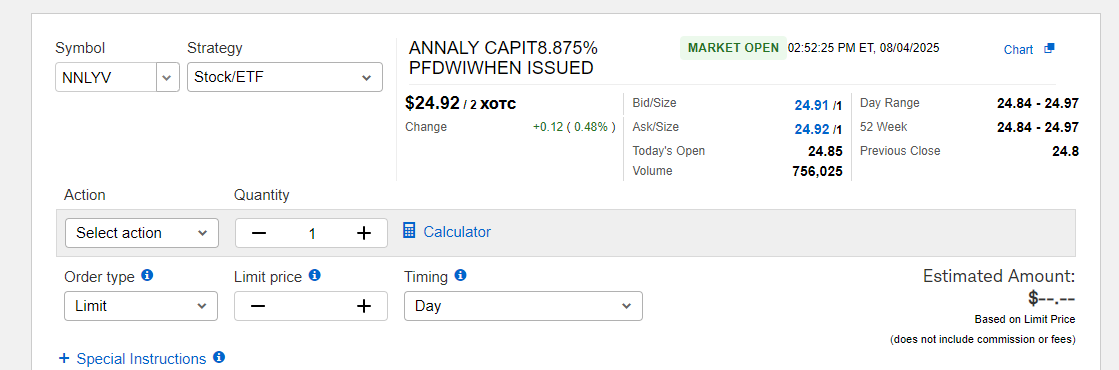

The shares currently trade as NNLYV, but are expected to become NLY-J.

To enter any orders, you would probably need to type in the ticker and hit "enter". Many services won't automatically fill this in as a suggested ticker. You can see an example from our Schwab account here:

Valuation here is pretty difficult because there are a handful of comparisons we could use and those comparisons result in different assessments. We don't have the targets set for NLY-J just yet, but I think the initial targets will be a little bit above $25.00.

Primary Alternatives

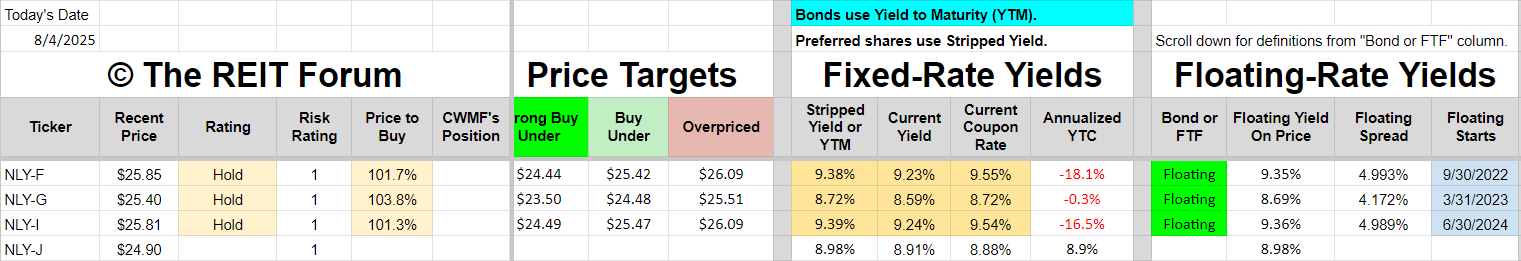

The first tool we would use to compare NLY-J is a comparison to the other preferred shares from NLY. I think NLY-J wins this comparison.

All 3 of the other preferred shares from NLY carry a negative yield to call. That's a big positive factor already.

We've got a stripped yield for NLY-J at 8.97%. That's better than NLY-G, but below NLY-F and NLY-I. Since those other preferred shares are already floating, the comparison is a bit more complex.

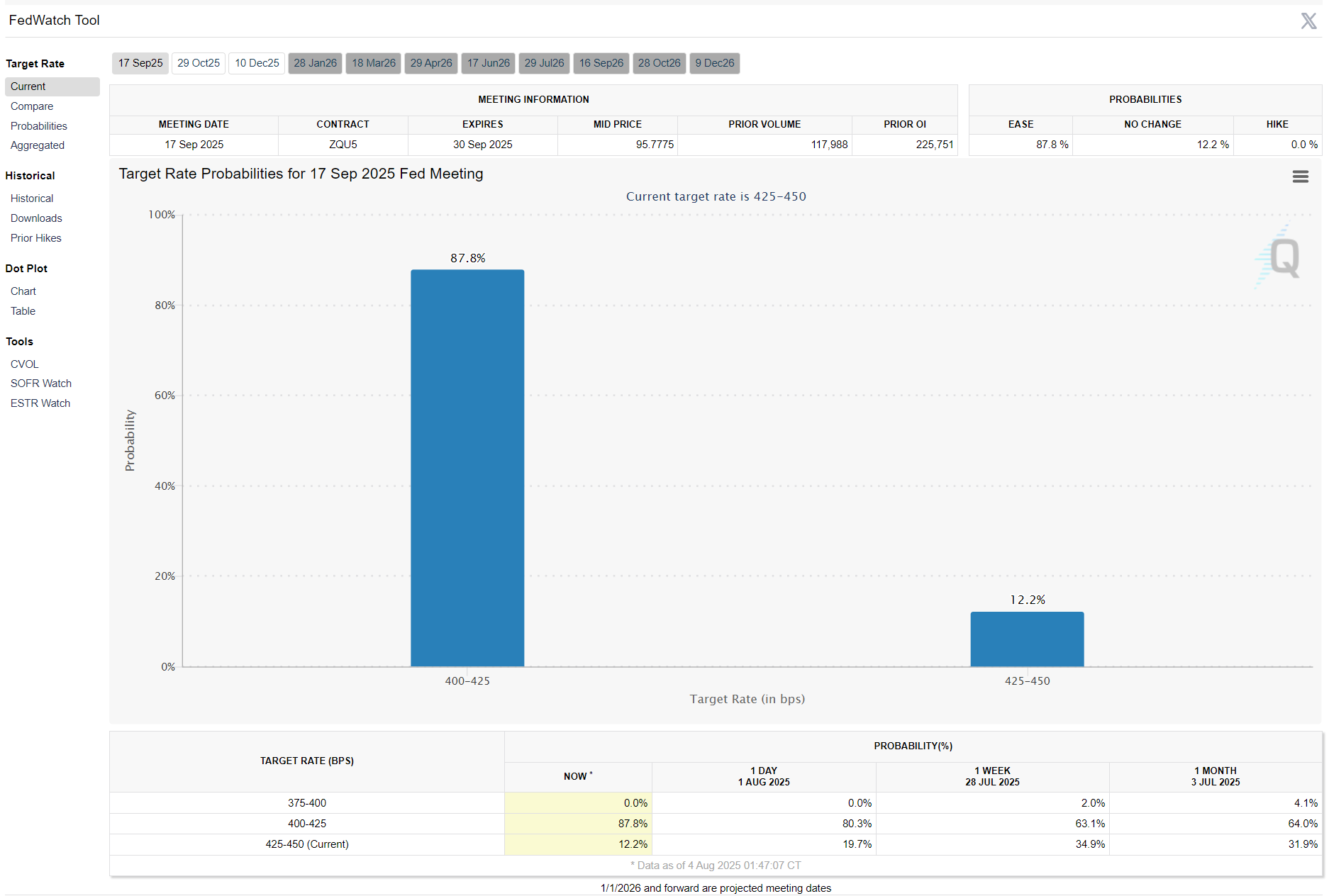

Even looking at the expected results for the next meeting of the Federal Reserve, the market is heavily expecting interest rates to be cut:

The market is predicting about an 88% chance of a cut. If rates were cut by 25 basis points (the most likely scenario), then the dividend rates on the floating-rate shares would all fall by 25 basis points. In that scenario, NLY-F and NLY-I would only be yielding a tiny bit more than NLY-J is today.

In such a scenario, NLY-J with about 5 years of call protection would look much better than NLY-F and NLY-I.

How about NLY-G? Well, the yield advantage for NLY-J would increase from nearly 30 basis points to about 55 basis points. That certainly favors NLY-J also.